Power Security Equals National Security: An Opportunity for Ports

How deeply will the rise of artificial intelligence (“AI”) change our lives? It could be as transformative as “the printing press, the steam engine, electricity, computing and the internet, among others” Jamie Dimon, CEO of JP Morgan Chase, noted in the company’s 2023 Annual Report.

But innovation comes with a cost. AI, and other emerging technologies, are power thirsty with a seemingly insatiable appetite. In Texas, industrial and business growth, combined with other factors, such the push for electrification of consumer products and weather extremities, has placed year over year record breaking strain on the grid, otherwise known as the Electric Reliability Council of Texas, or simply ERCOT.

Ports have an opportunity to lead industry response to these emerging energy challenges. The private sector, specifically maritime commerce related businesses, can make a material difference in hardening the ERCOT grid and, by extension, hardening their own facilities as well as their neighbors. Since U.S. ports aren’t just points of entry, but the epicenter of power security and national security, it is vital that port response to this increased power demand be comprehensive and forward-thinking.

Power Hungry Texas

Data centers are booming due to the rapid growth in technology, and they all need power. Presently, there are over 300 data centers in the Lone Star State, with more on the way. Texas is an attractive location because the cost of power is relatively low, and it is centrally located in the U.S. with a quickly growing population and expanding infrastructure. Specifically, North Texas is one of the largest markets for AI and data center growth, second only to Northern Virginia but ahead of Silicon Valley, Chicago and Phoenix. Similarly, the broader Austin-San Antonio region is second in the “secondary” market and is rapidly gaining speed.

Large companies with deep pockets are scrambling to buy up what land parcels they can, regardless of existing access to utility power. Parcels without current utility service either have interconnection or new service request submitted. The net result is utilities are gearing up for unprecedented growth over the next decade to meet what some suspect will be a tenfold increase in demand.

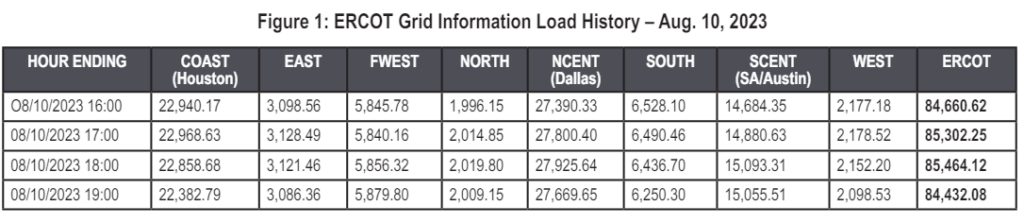

Texas is hot, increasing power needs. Every month from June through September of 2023, there were multiple days of record-breaking peak electricity demand. News media kept reminding Texans to avoid cranking up the A/C and encouraging judicial electricity use. On August 10, there was the greatest recorded electricity demand of 85,435 MWs. This was not a one-time occurrence. In the summer of 2023, ERCOT recorded ten instances of new peak demand records. Record peak demand has grown by 42% since 2005, and 16% since 2018. This upward trend line is likely to become steeper over the next decade.

Despite the demand, Texas (public and private) investment in dispatchable energy generation sources is largely considered inadequate. Further, many of the new dispatchable energy sources are in West Texas, geographically removed from the areas of greatest growth and demand. This geo-imbalance makes transmission from source to end user a significant and costly hurdle, further stressing transmission and distribution utilities already having difficulty keeping up with the demand. It also highlights the need for greater grid resiliency, particularly in these centers of growth to help prevent rolling blackouts.

The table in Figure 1 captures the peak demand hours on Aug. 10, 2023, recorded by ERCOT. The Houston, DFW, SA / Austin regions accounted for approximately 78% of demand, statewide. New generation sources (renewables or otherwise) are primarily in West Texas away from centers of growth, increasing grid vulnerability.

Existing Solutions

One planning tool ERCOT uses to help defend against rolling blackouts is “reserve margin”. Reserve margin is the difference between forecasted generation capacity and forecasted peak demand. ERCOT plans for a 13.75% reserve margin to allow for unforeseen events such as an unexpected demand surge or power plant failure.

Forecasted generation capacity includes renewable sources such as solar and wind. Correctly so, as renewable energy is an increasingly larger part of ERCOT’s grid capacity. According to ERCOT, solar and wind accounted for 38% of installed capacity and 31% of consumption in 2023. This is up from 10% in 2013. This trend is not slowing down. Renewable energy, specifically solar and wind, is forecasted to account for nearly 60% of new power generation sources in 2024, with solar accounting for 50% alone.

However, this is a double-edged sword, especially as demand increases and the reserve margin shrinks. Solar and wind generation are intermittent, and variable based on time of day and weather. As they continue to account for greater capacity, the broader ERCOT system places greater reliance on these intermittent sources. This variability makes managing balance (at any time capacity should match demand) much more complex. Balance is critical for maintaining a stable power supply. Lack of balance creates volatility in capacity, reserve margin and ultimately price.

Additionally, increased interest in solar and wind has naturally reduced investment in both legacy thermal generation assets and investment in new thermal generation which can often be considered a more flexible and reliable asset.

Coupled with increasing extreme weather events, the natural variability of and increased use of renewables, the lack of investment in legacy assets and power demand surges natural to extreme weather events has increased the risk of large-scale grid failure. In fact, this is exactly what caused grid problems during Winter Storm Uri in February 2021. This combination made keeping the lights on challenging for several days; more plants than expected were offline for maintenance, insufficient winterization led to lack of capacity, demand surged as the temperatures plummeted and renewable generation was much lower than expected.

The opposite end of this spectrum was summer 2023’s record-breaking heat and peak demand levels. In this case the grid, while certainly stressed, performed as designed. Solar generation was high and thermal generation plants experienced minimum unplanned shutdowns. Flexible thermal generation assets, most often onsite distributed generators, were dispatched when reserve margins were low, preventing catastrophic grid failure.

Opportunity for Ports

In addition to the current strategies in place, there are new, mutually-beneficial opportunities for industry to partner with ERCOT to match growing power demand. Because of their size and strategic role in industry, ports and maritime businesses are uniquely poised to capitalize on this partnership.

Ports account for over 616 million tons of cargo and generate $450 billion in economic value, approximately 25% of the GDP of Texas. With that large share of state GDP, the transportation sector (of which ports are simply a subset) is forecasted to consume about 12.3TWh of Texas total 365TWh (less than 3%) in 2025. But with the growth in volume through the ports, a greater portion of the Texas economy relies on a paradoxically small user of electricity (compared to other industrial sectors). This means that minor disruptions in ports’ energy supply create large disruptions in Texas’ economy.

More broadly, ports are also the beginning of domestic supply chain for many manufacturers and retailers in the state and across the U.S. The ripples caused by disruptions at ports have tremendous amplitudes and create shocks and whiplash for many producers, manufacturers and retailers in Texas and across the country. During Hurricane Harvey in 2017, approximately $2.5 billion dollars in lost business and transactions was realized due to closures at the port of Houston.

While electricity procurement and energy management can largely be afterthoughts, particularly when faced with the daily tasks of docking, loading, offloading Suezmax and Panamax, and VLCC sized vessels, there is relatively low hanging fruit available to be harvested. Fruit that grows in the orchard of ERCOT.

Creating a Power Partnerships

ERCOT is a deregulated energy market. In the ‘90s, vertically integrated local utilities owned generation, transmission, distribution, and retail pricing of electricity in the Lone Star State. Deregulation ended these monopolies by separating these functions into generation, transmission and distribution, and retail. What has evolved is a unique opportunity for business to partner with ERCOT, from both the demand and supply side, through their demand response (“DR”) and ancillary services programs.

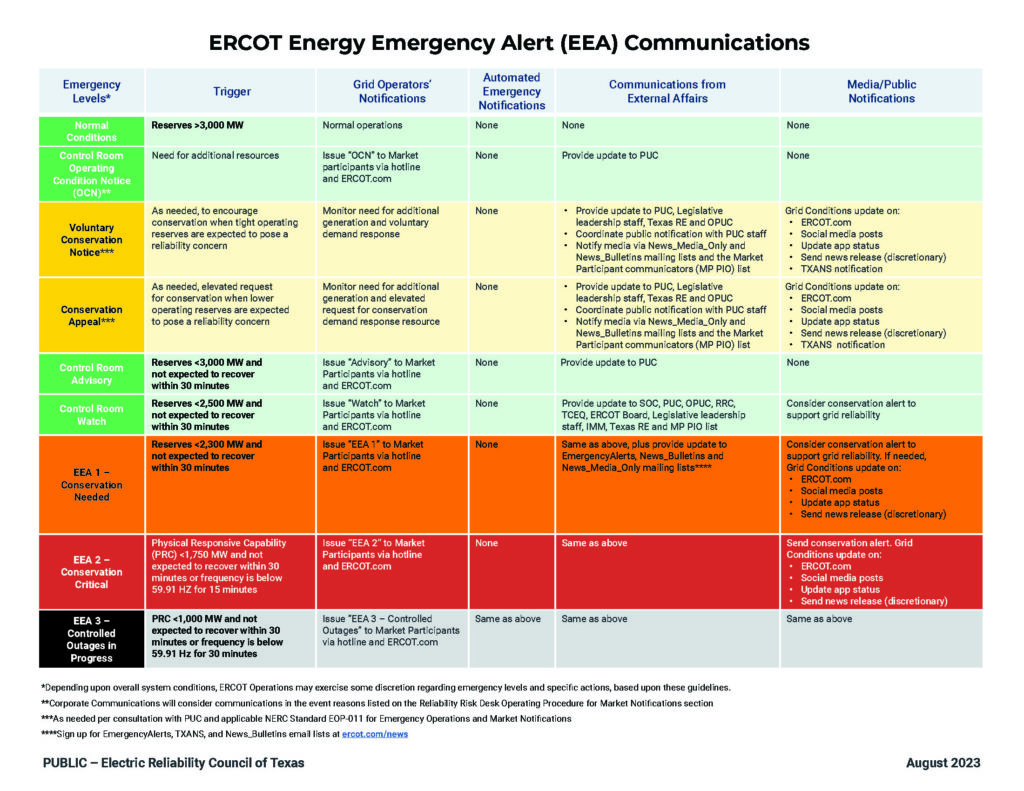

DR, and more specifically ERCOT’s Emergency Response Services (“ERS”) program is a situation-based contractual agreement between ERCOT program providers and businesses that provides ERCOT the ability to work with participating businesses and organizations to either curtail their load or to dispatch qualifying generators to inject electrons into the local grid. The incentive is ERCOT offers payments based on “a combination of time-indexed market prices, time to response and classification…” based on the operating reserves that ERCOT currently has on-line and operates the ERS program based on Energy Emergency Alert (“EEA”) criteria. The potential compensation a business receives varies but if the stars align, the potential payout can exceed $60K/MW-year. More importantly, it is a critical balancing tool that ERCOT uses to keep the grid operating.

While ports are power intensive, they account for a relatively small share of electric demand, which places a greater reliance on power for a much larger share of local economies. As facilities’ backup power generation approaches its end of life or a new piece of infrastructure is built that needs electricity, business owners and leaders should consider an energy procurement and management strategy that includes EPA compliant non-emergency use power generation systems for supplying backup power. These are Tier 4 final diesel generators or natural gas-fed systems that offer reliability, can incorporate renewables, and are behind the meter, grid-connected and able to operate in island mode. Likewise, if facilities currently have EPA compliant non-emergency use gensets, enrolling in DR programs allows businesses to actively participate in ERCOT’s marketplace, hardening the grid and generating revenue and savings to help offset program costs.

Finally, businesses cannot do this on their own and will require a strategic partnership with a qualified scheduling entity (“QSE”), an organization registered with ERCOT that can control interruptible and dispatchable resources. The QSE is responsible for interacting with ERCOT on behalf of the business and vice versa, managing load and generation dispatch, payments, and acting as the business’ broker in the day-ahead and real-time markets. They also oversee the not insubstantial administrative overhead and paperwork required to be an effective participant.

Port and Maritime Industry Benefits

ERCOT aggressively forecasts periods of grid concern and makes sure these specific times are communicated promptly through standard alerts and messaging. ERCOT’s Emergency Response Service (“ERS”) is their DR program that provides emergency supplemental load resources to the grid when reserve margins are at risk. To execute this program, ERCOT procures ERS resources from businesses four times per year for Standard Contract Terms (“SCT”). The SCTs are April – May, June – Sept, October – November, and December – March. Importantly, ERCOT pays whether they call upon \an asset for grid dispatch or not. If they do, the per hour price ERCOT will pay is likely to be substantial (demand < supply = higher price), increasing the potential revenue back to the business. Of note, ERCOT is planning for the summer 2024 June – September SCT. This is always the most financially beneficial period for an organization to participate. Finally, ERS does not necessarily require a generation asset; it can also be used by shedding load thereby freeing up electricity for other demand consumption.

Another compelling reason for partnership is that ERS participation directly prevents rolling blackouts, thereby mitigating the risk of a long-term grid failure. A business enrolling their industrial load backup power generation protects their own infrastructure, protects their neighbor’s infrastructure, and that of the entire port. It also helps businesses proactively manage their own load shed during abnormal demand, ensuring quality power is delivered to their most critical assets. It also helps ensure supply chain security, the continuity of maritime commerce, the shipment of goods into and out of the United States and help protect the local economy and workforce.

Another common and highly beneficial practice is the Four Coincident Peak Program, known as 4CP. Demand charges can amount to 20% – 40% of your monthly energy spend. 4CP curtailment is a voluntary practice that can generate savings on the monthly electric bill. 4CP prognostication and dispatch facilitates businesses in shedding load during four 15-minute peaks in June, July, August and September. The wild card is these peaks are unknown; though forecasts help inform participants when peaks may occur. Many participants exercise caution and will curtail their load for longer periods to help ensure they hit the right 15-minute window. Assuming the all the right peaks are hit, the payoff comes the next year in the form of greatly reduced transmission charges.

Ancillary services is another suite of ERCOT programs business can leverage to generate revenue. ERCOT purchases ancillary services in the day-ahead and real-time markets and then uses these to balance grid capacity and demand, lessening the risk of real-time operational disruptions.

Summary

The Texas grid remains at risk. Industrial and population growth, increased introduction of renewables into grid capacity adding a level of inherent risk brought by intermittency and adding complexity to balancing real-time capacity and demand, and a dynamic climate prone to natural disasters and extreme, prolonged periods of heat require a collaborative power partnership. The technological advances in AI are rapidly scaling innovation that continues to change the face of industries, including the maritime sector. Cutting age innovators and early adopters won’t stop innovating to wait for policy and grid infrastructure to catch up.

America’s economy ebbs and flows for many reasons, but our domestic supply chain begins and ends at ports. America’s ports do not work without access to secure, stable power. Texas, specifically ERCOT, presents a unique opportunity for maritime leaders to help cement grid security which is essential to commerce, innovation support and national security.

About the Author: Fritz Kuebler is the Director of Business Development at RPower. He can be contacted at: Fritz@RPower1.com